27+ mortgage rate lock meaning

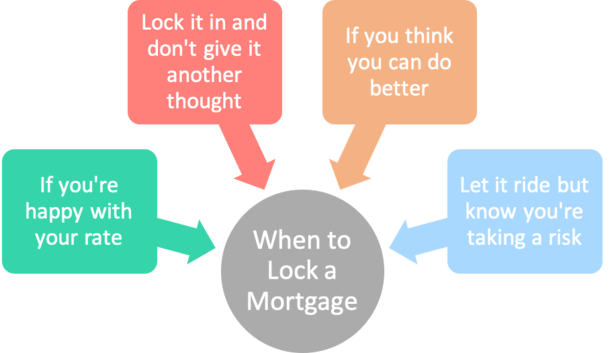

A rate lock freezes the interest rate on a mortgage usually for a fee paid when you agree to the terms of the loan. There are pros and cons to locking in.

Octane One Sour 27 5 S Kein Ragley Scout Chameleon Chisel H3 Bikemarkt Mtb News De

You may be able to.

. Web Whats a lock-in or a rate lock on a mortgage. Web A mortgage rate lock can save you money in the scenario that rates increase. Web Lock the rate in as soon as you see the one you want or when you first apply for the mortgage.

When you receive a mortgage loan offer a lender will usually ask if you want to lock in the rate for a period of time or float the rate. While this ensures your rate stays the same during the fixed rate period theres still a. Web With most lenders you can lock a rate once you have a full mortgage loan application meaning youve negotiated an accepted offer on your new home.

By locking in a mortgage rate you dont have to. Web Mortgage rates change frequently so if you dont have a rate lock the rate on your loan could go up or down before you close. This lock protects borrowers from the potential of rising interest rates d See more.

Web A rate lock is a guarantee from a lender that the offered interest rate with the associated points and credits for a mortgage is the rate that they will receive so long as their. Web What is a mortgage rate lock. However getting a good deal on your loan is a secondary benefit.

Web A mortgage rate lock is a commitment from a lender to guarantee a mortgage rate for a set period of time. Web What is a mortgage rate lock. Web Rate Lock Definition A rate lock refers to an agreement between a mortgage lender and a borrower to fix a certain interest rate for a number of days between the issuance of a.

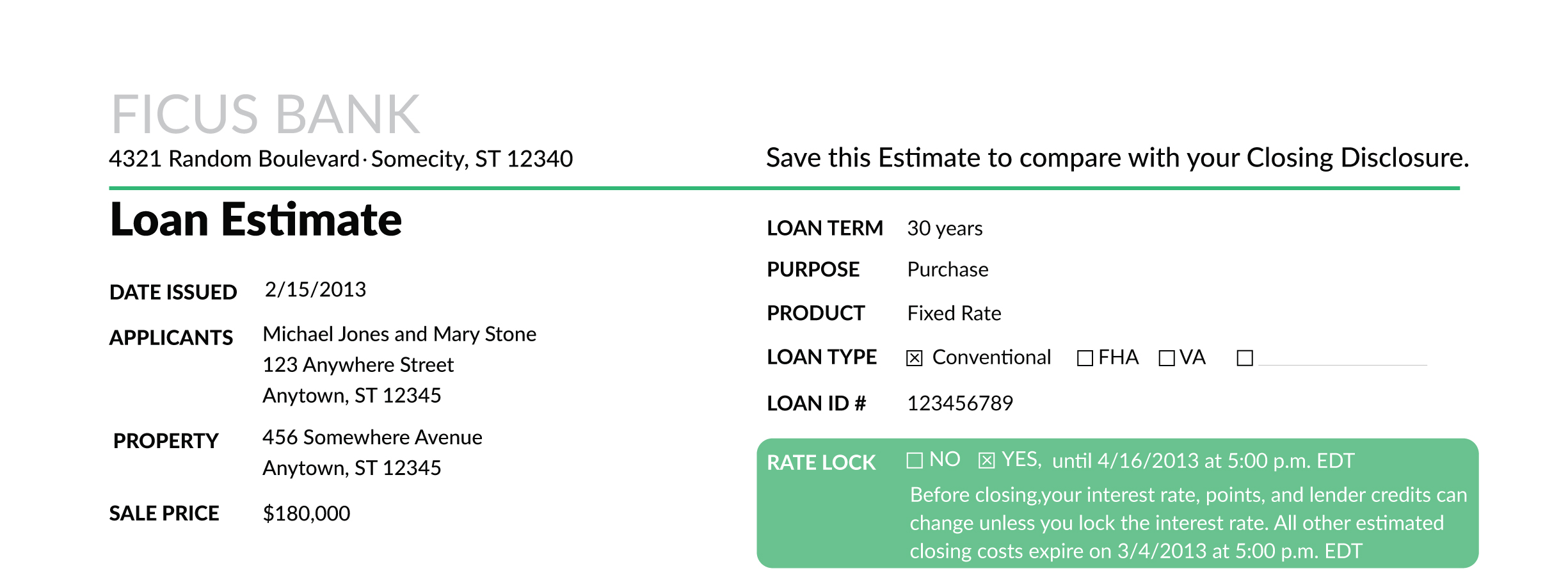

A lock-in or rate lock on a mortgage loan means that your interest rate wont change between the offer and closing. Web And the answer to that question is what were here to talk about extended rate locks. Web A mortgage rate lock is an agreement between you and your lender to temporarily lock your interest rate for a specific period of time typically 30 to 90 days.

That way your rate is locked as you spend time getting the application. The primary reason you should. If youre looking to borrow its a guarantee.

A mortgage rate lock sometimes called rate protection is a tool that allows you to lock an interest rate in place for a set period. A mortgage rate lock is an agreement between a borrower and a lender that allows tThe lender may charge a lock fee which the borrower must pay if they do not loA mortgage rate lock guarantees the current rate of interest on a home loan while a. Web To protect against any interest rate hikes many borrowers opt to fix their loan.

Web A mortgage rate lock is an agreement between borrower and lender that allows borrowers to lock in an interest rate. Web What Is a Mortgage Rate Lock. The term extended rate lock simply means that youre locking in the interest.

Gsl3bobi6v8f8m

Plenarvortrage Dpg Tagungen

Why It S Super Important To Lock Your Mortgage Rate

Mortgage Rate Locks The Complete Guide Fees Faq S More

10 Rate Lock Questions Explained Modern Home Lending

What Is A Mortgage Rate Lock Homewise

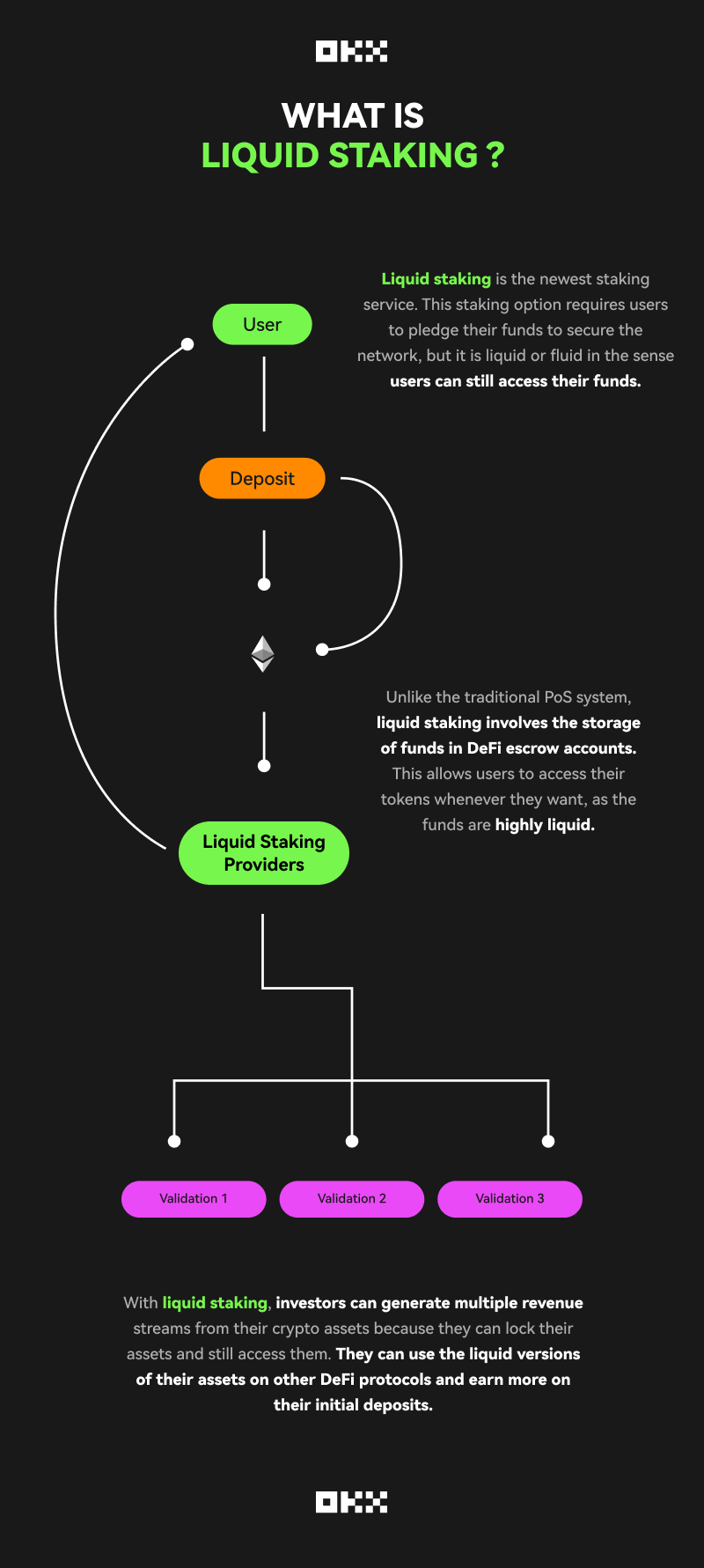

What Is Liquid Staking And How Does It Work Okx

Huggies Overnites Diapers 116 Ct Ralphs

Mortgage Rate Locks What Do They Mean

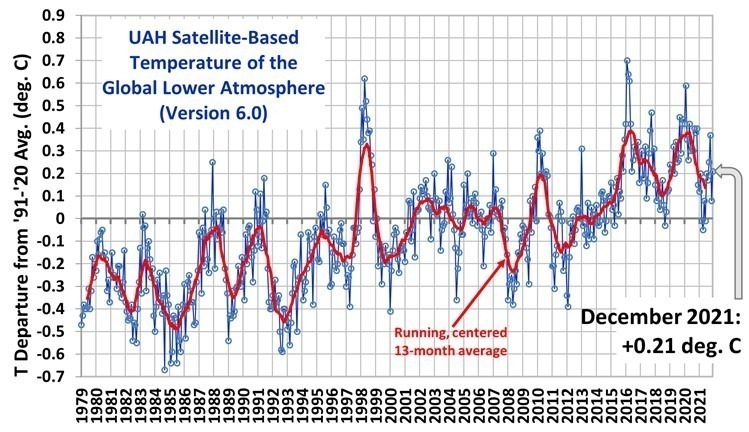

Uah Global Temperature Update For December 2021 0 21 Deg C Roy Spencer Phd

Hp Desktop Pcs All In One Pcs Hp Store Deutschland

10 Rate Lock Questions Explained Modern Home Lending

What Is A Lock In Mortgage Rate Charlotte Mires

![]()

Pdf Cislunar Navigation Technology Demonstrations On The Capstone Mission

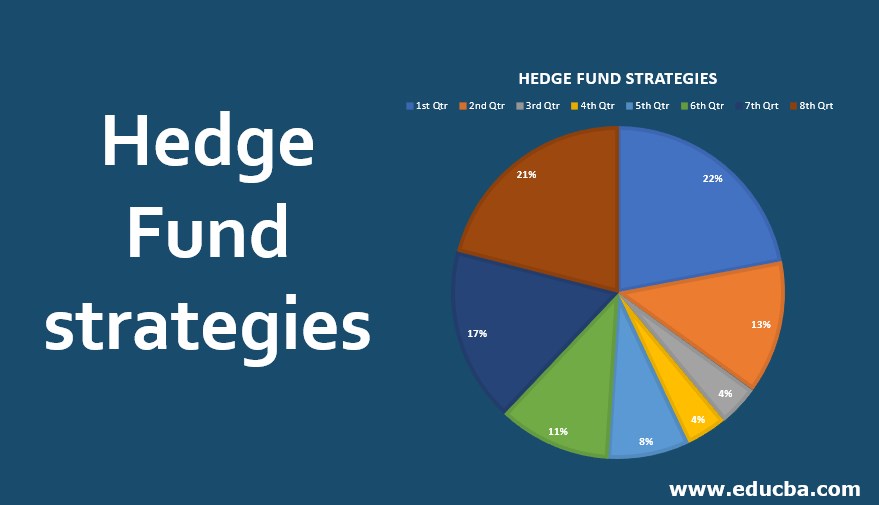

Hedge Fund Strategies For Managers Definition Examples Careers

Mortgage Rate Locks What You Should Know Lendingtree

The Importance Of Providing Required Documents For Home Loans